$20 Bonus + 25% OFF CLAIM OFFER

Place Your Order With Us Today And Go Stress-Free

This study is written for the revenue management of Pullman Quay Grand Sydney Harbour, for Vivid Sydney festival, a yearly event. It is a 5-star hotel in the very centre of Sydney and there is a large influx of visitors to the city (Pullman Hotels, 2024).

The main goal of this report is to examine the current booking data for the first 10 days of the festival vis-à-vis last year. Further, the report highlights the pricing strategy adopted by the hotel vis-à-vis the peers. Post above the report depicts two revenue management strategy to optimise the revenue for the hotel.

Analysis of OTB (on the Books) Vs. STLY (Same Time Last Year) Performance and Evaluation of Market Position and Competitive Strategy

To evaluate the hotel’s financial situation and strategic positioning during the first 10 days of Vivid Sydney 2024 festival, we will concentrate on the comparison of performance data Occupancy, Average Daily Revenue and overall revenue. This comparative analysis will involve a look at the trends and thereby make them relevant for adjusting the revenue management techniques (IvyPanda, 2024).

| OTB | STLY | % change | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Segment | occ% | ADR | Revenue | Rev Par | occ% | ADR | Revenue | Rev Par | occ% | ADR | Revenue | Rev Par |

| Direct,non-website | 1.7 | 382.9 | 4594.56 | 6.51 | 1.8 | 375.65 | 4883.45 | 6.76 | -5.56% | 1.93% | -5.92% | -3.73% |

| Website | 3.8 | 285.67 | 7713.09 | 10.86 | 5.1 | 280.81 | 10389.97 | 14.32 | -25.49% | 1.73% | -25.76% | -24.20% |

| OTA | 2.9 | 267.89 | 5625.69 | 7.77 | 3.1 | 258.93 | 5696.46 | 8.03 | -6.45% | 3.46% | -1.24% | -3.21% |

| Transient Total | 8.3 | 298.89 | 17933.34 | 24.81 | 10 | 291.25 | 20969.88 | 29.13 | -17.00% | 2.62% | -14.48% | -14.82% |

| Website | 12.4 | 272.35 | 24239.15 | 33.77 | 10.1 | 269.78 | 19693.94 | 27.25 | 22.77% | 0.95% | 23.08% | 23.94% |

| OTA | 13.8 | 247.47 | 24499.53 | 34.15 | 12.4 | 245.78 | 21874.42 | 30.48 | 11.29% | 0.69% | 12.00% | 12.06% |

| Discount Total | 26.1 | 259.25 | 48738.68 | 67.66 | 22.5 | 256.59 | 41568.36 | 57.73 | 16.00% | 1.04% | 17.25% | 17.20% |

| Negotiated | 8.6 | 274.75 | 17034.5 | 23.63 | 10.6 | 275.45 | 20934.2 | 29.20 | -18.87% | -0.25% | -18.63% | -19.07% |

| Consortia | 1.5 | 290.34 | 3193.74 | 4.36 | 1.1 | 288.73 | 2309.84 | 3.18 | 36.36% | 0.56% | 38.27% | 37.12% |

| Corporate Total | 10.1 | 277.1 | 20228.24 | 27.99 | 11.7 | 276.71 | 23244.04 | 32.38 | -13.68% | 0.14% | -12.97% | -13.55% |

| Group Total | 15.6 | 330.25 | 36998 | 51.52 | 12.6 | 328.98 | 29937.18 | 41.45 | 23.81% | 0.39% | 23.59% | 24.29% |

| Total | 60.1 | 286.12 | 123888.3 | 171.96 | 56.8 | 282.9 | 115719.5 | 160.69 | 5.81% | 1.14% | 7.06% | 7.01% |

Based on above computation, following inference may be drawn:

On an overall basis, the occupancy % as on date has higher by 5.81% which is positive for the group.

Group total has been the biggest contributor to the growth in occupancy and has witnessed a 23.81% growth in occupancy as compared to last year;

Corporate total has seen the a big fall in occupancy with a 13.68% decline in occupancy % as compared to last Year;

Discount Total has witnessed second largest rise and the rise stood at 16% in occupancy %;

Transient Total has witnessed the biggest fall in occupancy of 17% approx.

On an overall basis, the Hotel ADR has highest which is positive for the business However, the growth has not been significant;

The largest ADR rise has been seen in transient total while such growth has resulted in decline in occupancy %;

The lowest growth has been witnessed in Corporate Total and the said growth has been accompanied with fall in occupancy. Thus, in this sector business has got double hit.

On an overall basis, revenue is higher by 7.06% which is good for the hotel business and depicts strong management;

Highest growth in revenue shall be witnessed in Group business on account of high occupancy %;

Two segment of the business shall see a decline in revenue which are corporate and transient;

Discount segment shall contribute positively to the revenue of the business.

Rev Par has witnessed a growth of 7.01% on an overall basis which is positive for the Group;

Highest growth in Rev par shall be witnessed in Group business on account of high occupancy %;

Two segment of the business shall see a decline in Revpar which are corporate and transient;

Discount segment shall contribute positively to the Revpar of the business.

Further, a graphical presentation of contribution of various segment to overall revenue of the hotel has been presented as under:

Group has performed better which is on account of higher occupancy and slight rise in ADR;

Discount segment has performed better on account of high discount and low price compared to peers;

Transient has seen a fall on account of high ADR as compared to peers.

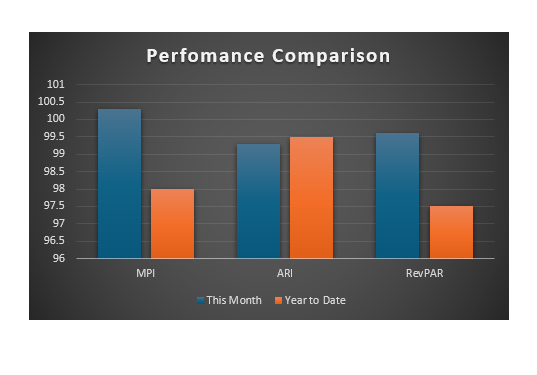

The Pullman Quay Grand Sydney Harbour’s relative standing among the high-end hotels in Sydney can be examined through important indicators such as the Average Rate Index (ARI), the Market Penetration Index (MPI), and the Revenue Generation Index (RGI).

ARI (Average Rate Index): The current Average Rate Index (ARI) is 99.3, revealing that the average daily rate of Pullman Quay Grand is slightly below the rest of the year and compared to competitors. This shows a strategy for pricing and reveals that hotel is betting on low price and higher occupancy strategy to achieve the desired revenue (HBenchmark, 2019).

MPI (Market Penetration Index): The value of the MPI is 100.3. This figure illustrates the fact that hotel captures a slightly larger portion of market occupancy than its competitors. The high MPI indicates that hotel has been able to obtain higher occupancy this month only. Further, in past month such occupancy rate has been lower compared to peer. The higher occupancy can be on account of pricing, visibility, customer perception or guest experience or promotion.

RGI (Revenue Generation Index): The RGI must be 99.5 suggests that hotel’s potential to generate revenues from available rooms is slightly lower as compared to its competitive counterpart. The RGI has improved in the current month as compared to previous period on account of higher occupancy at the hotels.

The ADRs at Pullman Quay Grand during the festival period fluctuates between $220 to $330 and is below the peers. Thus, hotel aims to penetrate the market through lower pricing strategy. The hotel has provided low price structure as compared to peers and thus aims to achieve higher occupancy through lower pricing. Accordingly, market penetration of the hotel has been carried out based on pricing difference. Strategy adopted is dynamic pricing along with segmentation as different price has been charged to different customers. Further from above data, it may also be seen that hotel has used distribution channel management strategy also Group total has achieved higher occupancy coupled with higher ADR.

Sydney Harbour Marriot, Sir Stamford and Intercontinental Sydney has also followed dynamic pricing and segmentation strategy while four seasons Sydney has adopted Dynamic Pricing along with distribution channel management.

Pullman Quay Grand’s somewhat discounted ADR points to the company’s strategy of attracting price-sensitive market segments. Nevertheless, this tactic does seem to translate to considerably greater occupancy demonstrated by MPI. It could be that as the rates are low, the persuasiveness of the marketing or guest experience and added-value services is as attractive compared to that of competitors which resulted in higher footfall.

Revenue Management Recommendations

For the purpose of maximising revenue for the Pullman Quay Grand Sydney Harbour during the Vivid Sydney festival, the inventory control measures like demand forecasting is to examine past data from past editions to predict hotel stays, food, and other service demand. In order to optimise revenue, modify hotel prices and inventory according to anticipated demand. Based on anticipated demand and commission rates, distribute room inventory among direct, OTA, and travel agency channels. Limit the number of rooms available on OTAs during periods of high demand to encourage direct reservations and lower commissions. In order to higher revenue from meals, spa services, and other services, provide packages and specials services to customers. As given to understand, the lowest ADR is for Discount Segment and highest is for Group segment. Thus, hotel should allocate lower rooms under discount segment when market demand is high and higher rooms where ADR is high. A balanced allocation of rooms under different segment shall help to ensure higher revenue and profitability (SiteMinder, 2024).

The second recommendation can be linked to other revenue management strategies such as market segmentation, pricing, product definition, competitor benchmarking or distribution management

Dynamic pricing need to be adopted in order to modify room rates in response to current demand and rival pricing. In order to fill rooms, raise rates during times of high demand and provide discounts during slower times. Put minimum stay requirements in place during periods of high demand to avoid one-night stays. The Pullman Quay Grand Sydney Harbour can maximise revenue during the Vivid Sydney event, drive direct bookings, and optimise pricing for each market segment by integrating dynamic pricing with these other revenue management tactics. Under this strategy, hotel shall charge different price to different customers as all customers are not ready to pay similar price. Thus, pricing strategy shall be essential to earn higher revenue.

As given above, higher price can be charged for Group Segment where in demand is not dependent on price. Thus, price differentiation strategy may be applied in the following manner i.e. charging higher price in some segment like Group while charging lower price under some category like Discount to maximise overall revenue (Revmanager, 2024).

The impact of Dynamic Pricing has been presented as under:

| OTB (Current) | OTB (Proposed) | |||||

| Segment | occ% | ADR | Revenue | occ% | ADR | Revenue |

| Direct,non-website | 1.7 | 382.9 | 4594.56 | 1.7 | 393 | 4715.754 |

| Website | 3.8 | 285.67 | 7713.09 | 3.8 | 288 | 7776 |

| OTA | 2.9 | 267.89 | 5625.69 | 2.9 | 272 | 5712 |

| Transient Total | 8.3 | 298.89 | 17933.34 | 8.3 | 303.40 | 18203.75 |

| Website | 12.4 | 272.35 | 24239.15 | 12.4 | 270 | 24030 |

| OTA | 13.8 | 247.47 | 24499.53 | 13.8 | 245 | 24255 |

| Discount Total | 26.1 | 259.25 | 48738.68 | 26.1 | 256.84 | 48285 |

| Negotiated | 8.6 | 274.75 | 17034.5 | 8.6 | 286 | 17732 |

| Consortia | 1.5 | 290.34 | 3193.74 | 1.5 | 300 | 3300 |

| Corporate Total | 10.1 | 277.1 | 20228.24 | 10.1 | 288.11 | 21032 |

| Group Total | 15.6 | 330.25 | 36998 | 15.6 | 380 | 42571.51 |

| Total | 60.1 | 286.12 | 123888.3 | 60.1 | 300.45 | 130092.3 |

Based on above it can be said that the hotel shall usage of comparative benchmarking to keep an eye on pricing changes and evaluate services provided by rivals .At the same time the hotel may optimise pricing, inventory, and marketing efforts to maximise revenue during events such as Vivid Sydney by precisely estimating demand. By executing the mentioned recommendation , Pullman Quay Grand Sydney Harbour can improve its methods for managing revenue, draw in more visitors, and maximise income during special occasions and busy times like the Vivid Sydney festival.

HBenchmark. (2019, December 7). Know the competitive positioning of your hotel by monitoring the ARI, MPI, RGI index. Retrieved May 23, 2024, from HBenchmark: https://en.hbenchmark.com/press/ari-mpi-rgi-index

IvyPanda. (2024, February 3). Pullman Quay Grand Sydney Harbour Hotel’s Revenue Management. Retrieved May 23, 2024, from IvyPanda: https://ivypanda.com/essays/pullman-quay-grand-sydney-harbour-hotels-revenue-management/

Pullman Hotels. (2024). Pullman Hotels and Resorts. Retrieved May 23, 2024, from Pullman: https://www.pullmanquaygrandsydneyharbour.com/

Revmanager. (2024, May 12). Strategic Price and Pricing in Revenue Management. Retrieved May 25, 2024, from Revenue management: https://revmanager.eu/strategy-price-and-pricing-in-revenue-management/

SiteMinder. (2024, May 2022). Hotel revenue management strategies and solutions. Retrieved May 25, 2024, from SiteMandir: https://www.siteminder.com/r/hotel-revenue-management-strategies/#:~:text=Beyond%20just%20room%20rates%2C%20inventory,at%20the%20most%20profitable%20rates.

Are you confident that you will achieve the grade? Our best Expert will help you improve your grade

Order Now