$20 Bonus + 25% OFF CLAIM OFFER

Place Your Order With Us Today And Go Stress-Free

The assessment should be written using Arial font size 10 and should be double spaced.

Follow the structure(s) outlined above; however, you may alter the wording of the headings and add sub-sections to your plan.

All ideas must be founded upon theoretical rationale and a solid understanding of the concepts related to the module. Support your decisions and rationale with proper sources and write using your own words based on research conducted. You should refer to the recommended sources for information within your course materials and beyond.

Apply the Harvard Citations Format.

You may use bullet points, graphs and charts and similar visual representations.

This assessment is a report in which you will focus on the entrepreneurial environment of a subsector and one organization operating within one of the six subsectors in the USA. The word limit of the report is 3000 Words.

After completing this report, you will be able to apply the concepts taught in the module and start visualizing things like a practitioner. Therefore, the purpose of this report is to integrate what you have learned in this module and apply it in the real world, while maintaining a manageable workload for the module

This module's main aim is to familiarize students with the key concepts that aspiring entrepreneurs must understand to start and excel in their entrepreneurial career with confidence, clarity, and conviction.

Therefore, this report acts as a brilliant opportunity to apply these concepts and understand key factors that influence entrepreneurial practice.

Identifying key entrepreneurial issues, both positive and negative, is crucial for organisations operating in a rapidly changing environment. By analysing these factors, companies like Tesla can better understand their market position and make informed decisions to mitigate risks, exploit opportunities, and achieve their goals. A critical evaluation of these issues can help companies to identify barriers to entrepreneurial practice and recommend solutions to improve their performance.

This report aims to critically evaluate the role of innovation and entrepreneurship in fulfilling broader organisational outcomes, with a focus on Tesla, an American electric vehicle (EV) manufacturer. Tesla has revolutionised the EV industry through its innovative products, technologies, and business models, and has become a leading player in the global automotive market (Ahmad et al. 2020). However, Tesla has also faced numerous challenges in its entrepreneurial journey, including regulatory hurdles, supply chain disruptions, and intense competition. Identifying and understanding entrepreneurial issues, both positive and negative, is essential for

Tesla to maintain its market position and competitiveness in the EV subsector. By analysing these issues, Tesla can identify potential threats and opportunities and make informed decisions about its strategic direction. For instance, Tesla's annual report 2021 identifies supply chain risks as a negative factor, and the company is taking steps to mitigate these risks by diversifying its supply chain and reducing dependence on single-source suppliers (Tesla.com, 2021).. Based on this, this report will analyse three key entrepreneurial issues that have positively impacted the EV sub sector and Tesla, and three key issues that have negatively impacted them. Moreover, the report will provide three potential recommendations for mitigating the negative factors identified in Task 3.

Also Read - Boost Juice Marketing Strategy

The electric vehicle (EV) subsector has gained significant attention in recent years due to increasing concerns about environmental pollution and sustainability. According to Exploding Topics, the global EV industry is currently valued at over $250 billion and is projected to grow at a compound annual growth rate (CAGR) of 22.1% from 2020 to 2027.

In the United States, EVs' market share of new registrations rose from 1.6% in 2019 to 3.1% in 2020, with Tesla leading the market (De Rubens et al. 2020).

The EV market has undergone significant growth in recent years, driven by increasing demand for sustainable transportation and government incentives. According to recent statistics, the global EV industry is projected to be valued at over $800 billion by 2027 (Gans et al. 2021).

There has also been a significant increase in the number of EV models available on the market, with more manufacturers investing in electric vehicle technology.

This has led to increased competition within the industry, with companies competing to offer the most innovative and affordable electric vehicles. However, as per Fang (2022), there are still challenges facing the EV market, such as limited charging infrastructure and high battery costs, which can impact entrepreneurial spirit and success.

The EV sub sector and companies such as Tesla have also created new business opportunities, with a growing demand for EV charging infrastructure and battery technologies. According to Entrepreneur, the EV charging station market is expected to reach $30.8 billion by 2027, providing opportunities for companies like Tesla to expand their services beyond EV manufacturing (Du and Li, 2021).

Furthermore, the shift towards EVs has also led to a growing demand for battery recycling and reuse, with opportunities for companies to develop innovative solutions to address environmental concerns (Cooke, 2020). Thus, the EV subsector is experiencing significant growth and presents opportunities for companies to innovate and develop sustainable solutions. Tesla's continued success in the EV market is a testament to the company's entrepreneurial approach and focus on performance, design, and sustainability.

Also Read - Hydrogen Ion Concentration Analysis

Tesla's history dates back to 2003, when it was founded with a mission to accelerate the world's transition to sustainable energy (Du and Li, 2021). The company's competitive strategy/response focuses on innovation and differentiation, with a strong emphasis on research and development to continuously improve and innovate its products.

Tesla's culture and values emphasise innovation, sustainability, and forward-thinking, attracting top talent and fostering an entrepreneurial spirit within the company (Fang, 2022). The company's flat structure and decentralised decision-making allow for quick and efficient decision-making, enabling it to remain agile and adapt to changes in the market.

Despite its successes, Tesla faces numerous challenges, including supply chain disruptions, increasing competition, and regulatory hurdles, which impact its entrepreneurial spirit and require ongoing innovative solutions (Gans et al. 2021).

Tesla is the world's leading EV manufacturer, with a market share of 17.2% in the EV market. Tesla's annual report 2021 highlights the company's continued growth, with production reaching 509,737 vehicles in 2020, a 37.4% increase from the previous year (Gowanlock, 2022).

The company's Model 3 was the world's best-selling EV in 2020, with over 365,000 units sold (Jing, 2020). Tesla's competitive advantage is its focus on performance, design, and sustainability, which has helped the company to differentiate itself from other EV manufacturers.

The first key entrepreneurial issue that has positively impacted the EV subsector and Tesla is technological innovation. Tesla has invested heavily in research and development to create high-performance EVs with longer ranges, faster charging times, and advanced features such as autonomous driving (Johnson and Reed, 2019). This has helped Tesla to differentiate itself from other EV manufacturers and establish a strong brand identity.

For instance, in 2021, Tesla launched the Model S Plaid, a high-performance sedan with a range of 390 miles and a top speed of 200 mph, which has received rave reviews from customers and critics alike (Khan, 2021). Tesla, a pioneer in the electric vehicle (EV) market, has faced various entrepreneurial issues that have impacted its operations positively and negatively. One key issue that has positively impacted Tesla is technological innovation (Reinhardt et al. 2019).

Tesla has invested heavily in research and development to create high-performance EVs with advanced features, such as autonomous driving, longer ranges, and faster charging times. As a result, Tesla's Model S Plaid, a high-performance sedan launched in 2021, received rave reviews from customers and critics alike (Rudeloff and Damms, 2022). Tesla's continuous technological advancements help it to stay ahead of its competitors and enhance its brand identity.

The second key entrepreneurial issue that has positively impacted the EV subsector and Tesla is customer engagement. Tesla has a unique direct-to-consumer sales model that allows customers to customise and order their vehicles online, and receive them directly from the company's factories (Lang, Reber and Aldori, 2021). Moreover, Tesla has created a strong community of brand loyalists who advocate for its products and services on social media and other platforms (Li, 2022). This has helped Tesla to generate buzz and demand for its vehicles without spending heavily on traditional advertising.

Tesla has a unique direct-to-consumer sales model, which allows customers to customise and order their vehicles online and receive them directly from the company's factories. Moreover, Tesla has established a strong community of brand loyalists who advocate for its products and services on social media platforms. Tesla's community of loyal customers has helped it to generate buzz and demand for its products without spending heavily on traditional advertising.

However, Tesla has faced various entrepreneurial issues that have negatively impacted its operations (Vivi and Hermans, 2022). One key issue is regulatory barriers. Tesla has faced restrictions on direct sales, tariffs on imported vehicles and components, and safety and environmental standards in different countries.

For example, in China, Tesla has faced scrutiny from regulators over safety issues and data privacy concerns, leading to a temporary halt in production at one of its factories (Zhang, 2022). These regulatory barriers increase Tesla's operational costs and hinder its expansion into new markets.

The third key entrepreneurial issue that has positively impacted the EV subsector and Tesla is vertical integration. Tesla has vertically integrated its supply chain by manufacturing its own batteries, electric motors, and other components, which has enabled it to reduce costs, improve quality control, and speed up production (Liu, 2022).

For instance, in 2022, Tesla announced plans to build a new battery factory in Texas, which will be the world's largest, and will help the company to achieve its goal of producing 20 million EVs per year by 2030 (Peterson and Wu, 2021). The key entrepreneurial issues of technological innovation, customer engagement, and vertical integration have positively impacted Tesla.

Tesla's strong investment in R&D has helped it to create high-performance EVs with advanced features, which have helped it to differentiate itself from competitors. Tesla's unique direct-to-consumer sales model has also allowed for a strong community of brand loyalists who advocate for its products and services (Przychodzen, Leyva‐de la Hiz and Przychodzen, 2020).

Moreover, Tesla's vertical integration has allowed it to reduce costs and speed up production, enabling it to achieve its ambitious production targets. These factors have helped Tesla establish itself as a leader in the EV sub sector and drive its growth and success in the market.

Figure 1: Tesla investment in R&D

(Source: Tesla.com, 2020)

Despite the challenges, the EV market is expected to grow significantly in the coming years, creating potential opportunities for Tesla. According to a report by ResearchAndMarkets, the global EV market is expected to grow at a CAGR of 22.6% from 2021 to 2028 (Gans et al. 2021).

Furthermore, Tesla's vertically integrated supply chain and battery technology provide it with a competitive advantage over its competitors. Tesla's planned new battery factory in Texas, which will be the world's largest, will further enhance its production efficiency and cost-effectiveness (Du and Li, 2021).

In conclusion, Tesla's success as an EV manufacturer is attributed to its continuous technological innovation, customer engagement, and vertical integration. However, the regulatory barriers, supply chain disruptions, and intense competition pose significant challenges to Tesla's operations (Fang, 2022).

Nevertheless, the potential opportunities in the growing EV market and Tesla's competitive advantage provide a path for its continued success.

Also Read - Human-Centred System Design

One of the key entrepreneurial issues creating negative impact is the lack of charging infrastructure. Despite the increasing popularity of EVs, the charging infrastructure remains inadequate, particularly in some regions of the world.

The lack of charging stations reduces the convenience of owning an EV, and range anxiety remains a significant concern among potential buyers. The International Energy Agency estimates that by 2030, there will be a need for 10 million public chargers globally to meet the increasing demand for EVs.

In the United States, only 100,000 public charging stations are currently available, according to the Department of Energy (Reinhardt et al. 2019). This lack of charging infrastructure is a significant challenge for Tesla as it seeks to increase its market share in the EV market.

Tesla has attempted to address this issue by expanding its Supercharger network, but this is a capital-intensive undertaking that will take time to implement. Range anxiety, or the fear of running out of battery charge while driving, remains a significant concern for many consumers.

According to a survey by Deloitte, 58% of American drivers are hesitant to buy an EV due to concerns about the availability of charging stations and the time it takes to charge their vehicles. In addition, the lack of charging infrastructure in many regions limits the practicality of EVs for long-distance travel (Rudeloff and Damms, 2022).

This issue is particularly relevant to Tesla, which has a significant advantage over its competitors in terms of range, but still faces challenges in expanding its charging network to cover more areas.

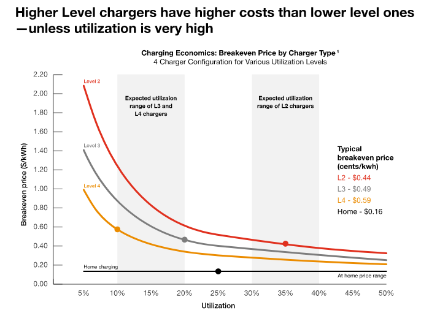

Figure 2: Costs of EV market

(Source: Reinhardt et al. 2019)

The second key entrepreneurial issue that has negatively impacted the EV subsector and Tesla is intense competition. Tesla faces intense competition from other EV manufacturers such as General Motors, Ford, Volkswagen, and Chinese startups such as NIO and Xpeng, which are also investing heavily in EVs and developing advanced technologies (Lang, Reber and Aldori, 2021).

This has led to pressure on Tesla to innovate faster, reduce costs, and expand its market share, which can be challenging in a rapidly changing and competitive industry. The regulatory barriers, supply chain disruptions, and intense competition in the EV sub sector have negatively impacted Tesla's growth and profitability (Liu, 2022). The regulatory hurdles, such as restrictions on direct sales and safety standards, have led to production delays and increased costs, affecting Tesla's operational efficiency.

Moreover, supply chain disruptions, such as shortages of semiconductors, batteries, and raw materials, have hampered Tesla's production capacity, leading to revenue losses (Peterson and Wu, 2021). Furthermore, intense competition from other EV manufacturers has forced Tesla to innovate faster and reduce costs, which can be challenging. Thus, Tesla must find ways to overcome these challenges to maintain its market leadership in the EV subsector.

Figure 3: EV market competition

(Source: Peterson and Wu, 2021)

The sector has also faced entrepreneurial issues because of the high cost of EVs. In addition to the regulatory barriers, supply chain disruptions, and intense competition, there are other key issues that have negatively impacted the EV market and Tesla. One of these issues is the high cost of EVs.

According to a report by BloombergNEF, the average cost of an EV in 2020 was $19,000 more than an equivalent internal combustion engine (ICE) vehicle (Vivi and Hermans, 2022). This cost difference is primarily due to the high cost of batteries, which account for up to 50% of the total cost of an EV.

Despite the decline in battery costs in recent years, EVs are still more expensive than ICE vehicles, making them less affordable for many consumers. This issue is particularly relevant to Tesla, which has positioned itself as a premium EV brand with a focus on performance and luxury.

While Tesla has lowered the cost of its entry-level Model 3, its other models such as the Model S and Model X are still relatively expensive, limiting their appeal to a wider consumer base (Zhang, 2022).

The third issue is consumer adoption barriers. Despite the growing popularity of EVs, many consumers still have reservations about buying an EV due to a lack of knowledge about EV technology, concerns about range and charging infrastructure, and a perception that EVs are less convenient than ICE vehicles.

According to a report by McKinsey, 30% of consumers are unaware of the benefits of EVs, while 35% are concerned about the limited range (Zhou, 2023). Tesla has attempted to address these barriers by emphasising the performance and convenience of its EVs, but there is still a significant education and awareness gap that needs to be addressed to increase consumer adoption.

To overcome these issues, the EV industry and Tesla need to focus on several key strategies (Du and Li, 2021). First, battery costs need to continue to decline to bring the cost of EVs in line with ICE vehicles.

According to a report by the International Energy Agency, the cost of batteries needs to fall below $100 per kilowatt-hour to achieve price parity with ICE vehicles (Gans et al. 2021). This will require continued investment in battery technology and manufacturing, as well as regulatory support for EVs.

Hence, the range and charging infrastructure needs to be expanded to increase the practicality of EVs for long-distance travel. This will require significant investment in charging infrastructure, including fast charging stations and battery swapping technology (Gans et al. 2021).

Tesla has a significant advantage in this area, but it needs to continue to invest in expanding its charging network to cover more regions and increase its appeal to a wider consumer base. Finally, consumer education and awareness need to be increased to address the knowledge gap and perception barriers to adoption.

This will require a collaborative effort between industry stakeholders, governments, and consumer organisations to increase awareness about the benefits of EVs and address concerns about range and charging infrastructure (Zhou, 2023). Tesla can play a significant role in this effort by emphasising the convenience and performance of its EVs and investing in consumer education programs.

In conclusion, the high cost of EVs, limited range and charging infrastructure, and consumer adoption barriers are key issues that have negatively impacted the EV market and Tesla. To overcome these issues, the industry and Tesla need

Based on the analysis of the entrepreneurial issues that negatively impact the EV subsector and Tesla, several recommendations can be made to mitigate these challenges:

Diversify the product portfolio: To reduce dependence on a single product line and mitigate supply chain issues, Tesla can explore diversifying its product portfolio by investing in new EV models for different market segments. This can include smaller, more affordable EVs that cater to the mass market, and larger EVs that cater to commercial and industrial clients (Du and Li, 2021).

Increase production capacity: With the increasing demand for EVs, Tesla needs to increase its production capacity to meet the growing market demand. The company can explore setting up new production facilities in strategic locations to cater to different regional markets (Gans et al. 2021). Additionally, Tesla can partner with other manufacturers to share production facilities and reduce supply chain issues.

Invest in research and development: To stay ahead of the competition, Tesla needs to continue investing in research and development to improve the quality and performance of its EVs. The company can explore developing new battery technologies that improve EV range and charging times (Jing, 2020). Additionally, Tesla can explore developing new autonomous driving technologies that improve driving safety and convenience.

Build strong relationships with suppliers: To mitigate supply chain issues, Tesla can focus on building strong relationships with its suppliers by investing in supplier development programs. This can include training programs to improve supplier capacity and quality, and collaborative initiatives to improve supply chain efficiency.

Enhance cybersecurity measures: As EVs become increasingly connected, cybersecurity becomes a critical concern. Tesla needs to invest in enhancing its cybersecurity measures to protect its vehicles and customer data from cyber threats. This can include investing in cybersecurity technologies, conducting regular cybersecurity assessments, and training employees to identify and mitigate cyber threats (Jing, 2020).

In conclusion, the EV subsector and Tesla face several entrepreneurial issues that negatively impact their operations. However, by implementing the above recommendations, Tesla can mitigate these challenges and continue to lead the EV market.

Overall, the analysis of the three key entrepreneurial issues and three additional issues that negatively impact the EV subsector and Tesla has shed light on various challenges faced by the company. The discussion has highlighted the significance of factors such as government regulations, competition, and supply chain management in the EV industry. The recommendations provided can help mitigate these issues and improve the company's performance. Overall, it is clear that the entrepreneurial process in the sub sector and organisation is complex and requires continuous adaptation and innovation to succeed in a highly dynamic market.

Ahmad, F., Saad Alam, M., Saad Alsaidan, I. and Shariff, S.M., 2020. Battery swapping station for electric vehicles: opportunities and challenges. IET Smart Grid, 3(3), pp.280-286.

Cooke, P., 2020. Gigafactory logistics in space and time: Tesla’s fourth gigafactory and its rivals. Sustainability, 12(5), p.2044.

De Rubens, G.Z., Noel, L., Kester, J. and Sovacool, B.K., 2020. The market case for electric mobility: Investigating electric vehicle business models for mass adoption. Energy, 194, p.116841.

Du, X. and Li, B., 2021, December. Analysis of Tesla’s Marketing Strategy in China. In 2021 3rd International Conference on Economic Management and Cultural Industry (ICEMCI 2021) (pp. 1679-1687). Atlantis Press.

Fang, J., 2022, July. An Overall Financial Analysis of Tesla. In 2022 2nd International Conference on Enterprise Management and Economic Development (ICEMED 2022) (pp. 1233-1238). Atlantis Press.

Gans, J.S., Kearney, M., Scott, E.L. and Stern, S., 2021. Choosing technology: An entrepreneurial strategy approach. Strategy Science, 6(1), pp.39-53.

Gowanlock, J., 2022. Tesla the Maker: The Stakes of Differing Histories of Technology in DIY Cultures. Technoculture: An Online Journal of Technology in Society, 12.

Jing, N., 2020, December. Research on Tesla’s Customer Care Innovation. In 2020 Management Science Informatization and Economic Innovation Development Conference (MSIEID) (pp. 469-478). IEEE.

Johnson, A. and Reed, A., 2019. Tesla in Texas: A Showdown Over Showrooms. SAM Advanced Management Journal, 84(2), pp.47-3.

Khan, M.R., 2021. A critical analysis of Elon Musk’s leadership in Tesla motors. Journal of Global Entrepreneurship Research, pp.1-10.

Lang, J.W., Reber, B. and Aldori, H., 2021. How Tesla created advantages in the ev automotive paradigm, through an integrated business model of value capture and value creation. Business & Management Studies: An International Journal, 9(1), pp.385-404.

Li, J., 2022. Tesla's transcendence of traditional industries and its prospects. Highlights in Business, Economics and Management, 4, pp.109-115.

Liu, J., 2022, December. Research on the Tesla's Business Model Analysis. In 2022 4th International Conference on Economic Management and Cultural Industry (ICEMCI 2022) (pp. 828-835). Atlantis Press.

Peterson, A. and Wu, A., 2021. Entrepreneurial learning and strategic foresight. Strategic Management Journal, 42(13), pp.2357-2388.

Przychodzen, W., Leyva‐de la Hiz, D.I. and Przychodzen, J., 2020. First‐mover advantages in green innovation—Opportunities and threats for financial performance: A longitudinal analysis. Corporate Social Responsibility and Environmental Management, 27(1), pp.339-357.

Reinhardt, R., Christodoulou, I., Gassó-Domingo, S. and García, B.A., 2019. Towards sustainable business models for electric vehicle battery second use: A critical review. Journal of environmental management, 245, pp.432-446.

Rudeloff, C. and Damms, J., 2022. Entrepreneurs as influencers: the impact of parasocial interactions on communication outcomes. Journal of Research in Marketing and Entrepreneurship, (ahead-of-print).https://www.ingentaconnect.com/content/hsp/jdsmm/2022/00000010/00000003/art00006

Vivi, M. and Hermans, A.M., 2022. “Zero Emission, Zero Compromises”: An Intersectional, Qualitative Exploration of Masculinities in Tesla’s Consumer Stories. Men and Masculinities, 25(4), pp.622-644.

Zhang, Y., 2022, December. Venture Capital Investment Decisions on Tesla. In 2022 International Conference on Economics, Smart Finance and Contemporary Trade (ESFCT 2022) (pp. 150-156). Atlantis Press.

Zhou, Z., 2023. Tesla Marketing Analysis. Academic Journal of Business & Management, 5(2), pp.171-177.

Are you confident that you will achieve the grade? Our best Expert will help you improve your grade

Order Now